From an industry point of view, “stuffed toy” is the broader category. It refers to any toy that is filled with materials like polyester fiber, cotton, or foam, and this can include animals, dolls, characters, or even novelty shapes. The focus here is structure and function, meaning the toy is soft, squeezable, and safe, which makes it suitable for mass production, promotional use, and large retail programs.

“Plush toy,” on the other hand, is more about the surface experience and emotional value. Plush usually describes toys made with softer, longer, and higher-quality fabrics, often designed to feel comforting, premium, and gift-worthy. In many overseas markets, especially in North America and Europe, the word “plush” immediately signals softness, warmth, and a stronger emotional connection, rather than just a basic stuffed product.

For buyers, this distinction directly affects procurement decisions. If a procurement manager is sourcing toys for supermarket shelves, seasonal promotions, or fast-moving inventory, they may lean toward standard stuffed toys because they are easier to scale, more cost-controlled, and flexible in design. These products are often price-sensitive, packaging-driven, and focused on volume rather than long-term engagement.

However, buyers who are building brands, especially in the plush toy segment, tend to think very differently. They care about fabric texture, stitching quality, facial expression design, and how the toy makes the end user feel after weeks or months of use. Plush toys are more likely to be associated with emotional bonding, bedtime routines, and long-term companionship, which means buyers in this space are usually more open to higher unit prices and value-added features.

This is also where the market has been changing over the last few years. Buyers are no longer just asking, “Is it soft?” or “Is it safe?” Instead, they’re asking questions like: Can this plush toy interact? Can it tell stories? Can it adapt to different ages? Can it become more than just a passive comfort object?

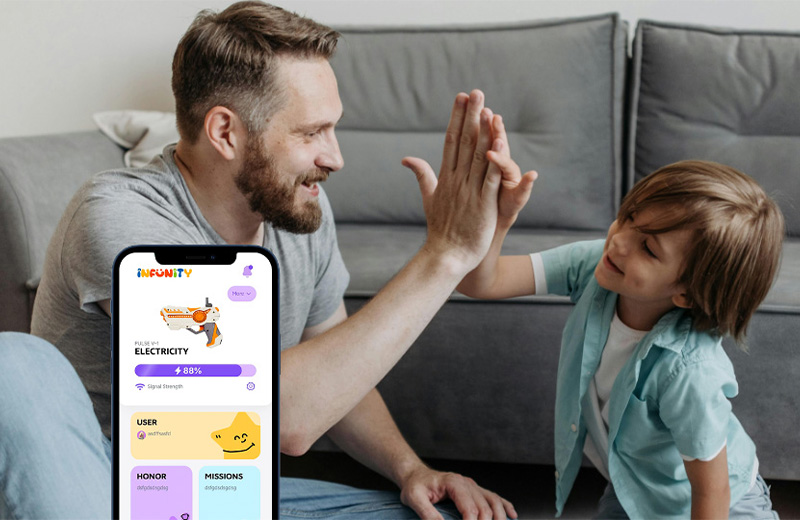

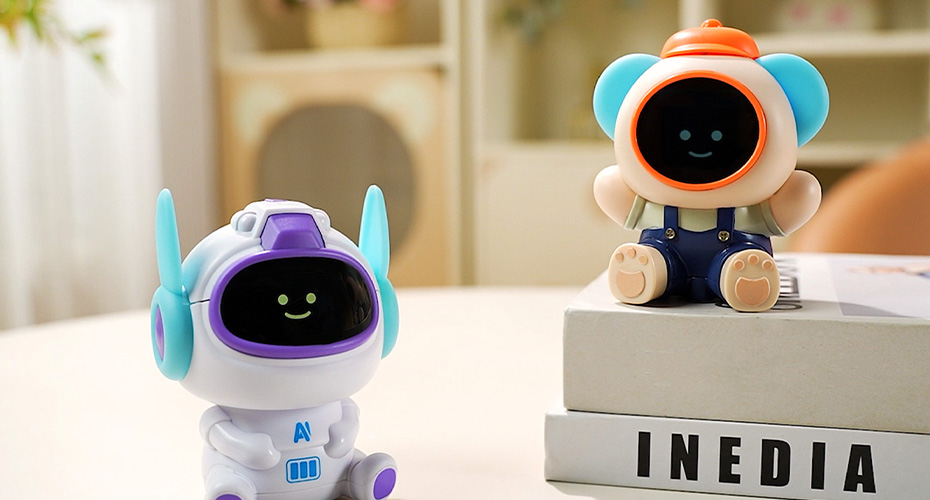

That shift is exactly where companies like INFUNITY are positioning their product strategy. Coming from over 20 years of traditional toy manufacturing experience, INFUNITY understands both sides of the equation, the scalability of stuffed toys and the emotional depth of plush toys. Their newer product concepts are designed to merge the comfort and familiarity of plush toys with AI-driven interaction, which gives buyers a completely different value proposition.

For procurement teams, an AI-enhanced plush product from INFUNITY is no longer just a SKU on a shelf. It becomes a differentiated item that can support storytelling, learning, and ongoing engagement, which is especially attractive for buyers targeting higher-end retail channels, educational distributors, or brands looking to stand out in a crowded plush market.

In practical terms, buyers choosing between plush and stuffed toys today are really choosing between short-term volume and long-term brand value. Stuffed toys still make sense for price-driven programs, but plush toys, especially smart or interactive ones, are increasingly favored by buyers who want repeat purchases, stronger customer loyalty, and products that feel meaningful rather than disposable.

So, are plush and stuffed toys the same? Technically, they overlap. From a buyer’s perspective, though, they represent very different strategies. And as the industry continues to move toward emotional interaction and intelligent play, plush toys combined with AI, like those developed by INFUNITY, are becoming the option that more forward-thinking buyers are actively looking for.

Recommended for You

Recommended for You